Approved contributions

Our experts welcome many automobiles, trucks, vans, fleet vehicles, trailers, boats, motorcycles, and Motor homes, contingent on approval. We have reps on hand to resolve just about any inquiry you may perhaps have which includes: "what you may donate?" and "what state of automobiles are actually allowed?" Please call us toll free at: (888) 228-1050

What records are documentation is needed?

In many cases In many cases we will certainly need the title to the car, but every single state has its own unique requirements. Even in the event that you do not hold title papers, consult with us anyway; alternative arrangements may be put together in a large number of cases in many cases. You may connect with us by phoning us toll free at: (888) 228-1050

We appreciate your cars and truck donation, and our people really want to help make that possible for you. If you have any other concerns, you can surely check our cars and truck donation FAQ. Our agents are standing by on the phone, all ready to really help you recognize any documentation you are in need of to donate your motor vehicle.

Will I have the chance to pick up a tax deduction?

You bet, cars donated to registered non-profit organizations are actually tax deductible. Given that we are a 501( c)( 3) non-profit organization, your automobile donation to Driving Successful Lives is totally tax deductible. Once we obtain your auto donation, we will mail you a receipt that clarifies your tax deduction amount.

In general, if the vehicle you contribute sells for less than $five hundred, you can state the fair market value of your automobile up to $500. If your donated car or truck sells for more than here $500, you will definitely have the ability to claim the true amount of money for which your vehicle sold. Learn more about how the IRS allows you to claim a tax deduction for your car donation on our IRS Tax Information page.

Your automobile donation to an IRS accredited 501( c)( 3) charitable organization is still tax deductible and will fall into definitely one of these sectors:

1. With charity car donation regard to car read more or trucks sold for lower than $five hundred, you may declare the reasonable market value right up to $500.00 without needing any special documents. The initial tax receipt will certainly be transmitted right after automobile has been proven picked up.

2. On the occasion that the aggregate receipts from the sale of your donated auto go above and beyond $500.00, your credit will definitely be set to the real price. You will also be asked by the donee organization to provide your check here Social Security for the purposes of completing its IRS Form 1098-C form.

Our team definitely will present you with a letter affirming the final price of your motor vehicle in a matter of one month of its sale.

Can you supply free pick-up?

Absolutely, we are going to grab the vehicle working or otherwise absolutely free, from a locality more info that is convenient for you. Whenever you fill in our web-based donation form we will contact you the exact same or succeeding business day so as to arrange your vehicle pick-up. If you make your motor vehicle donation through calling us at: PHONE. We definitely will arrange for your pick-up at that point.

Who exactly benefits?

Our motor vehicle donation program helps community charities that aid children and families who need food & shelter. Your vehicles donation really helps make aspirations come to life in a range of methods-- including holiday gifts.

We will also grant funding to organizations that help Veterans.

Your cars and truck donation benefits disabled US veterans through raising bucks to deliver financing for assorted programs to serve to help take care of their essentials.

Barret Oliver Then & Now!

Barret Oliver Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Macaulay Culkin Then & Now!

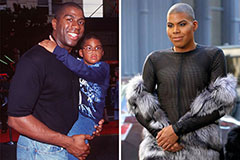

Macaulay Culkin Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now!